Journal entries often use the language of fundamental accounting equation debits (DR) and credits (CR). A debit refers to an increase in an asset or a decrease in a liability or shareholders’ equity. A credit in contrast refers to a decrease in an asset or an increase in a liability or shareholders’ equity. This equation sets the foundation of double-entry accounting, also known as double-entry bookkeeping, and highlights the structure of the balance sheet. Double-entry accounting is a system where every transaction affects at least two accounts.

Formula

In the case of a limited liability company, capital would be referred to as ‘Equity’. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. This is how the accounting equation of Laura’s business looks like after incorporating the effects of all transactions at the end of month 1. In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

What is the fundamental accounting equation?

Deskera Books is an online accounting software https://www.facebook.com/BooksTimeInc/ that enables you to generate e-Invoices for Compliance. It lets you easily create e-invoices by clicking on the Generate e-Invoice button. With Deskera you can automate other parts of the accounting cycle as well, such as managing inventory, sending invoices, handling payroll, and so much more.

Organization

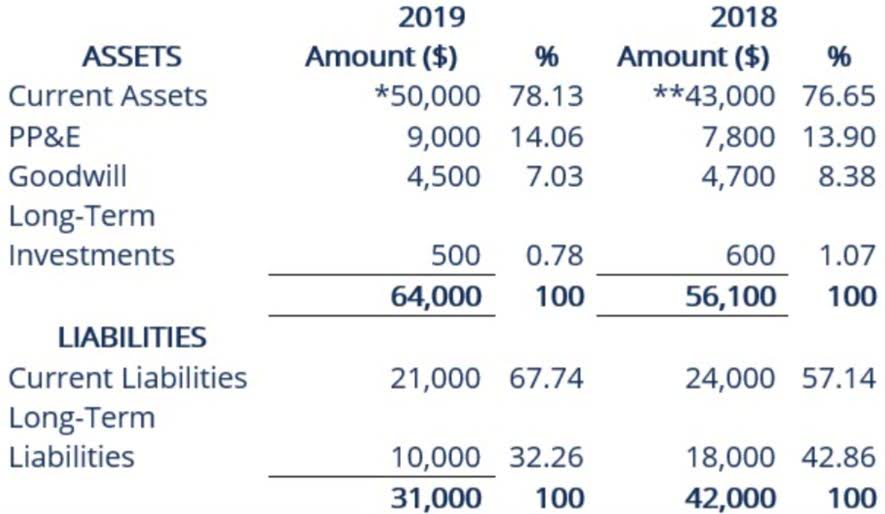

- From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

- An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future.

- It’s telling us that creditors have priority over owners, in terms of satisfying their demands.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Drawings are amounts taken out of the business by the business owner.

Therefore cash (asset) will reduce by $60 to pay the https://www.bookstime.com/ interest (expense) of $60. Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off. Incorrect classification of an expense does not affect the accounting equation.

The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital). Capital essentially represents how much the owners have invested into the business along with any accumulated retained profits or losses. After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash.

The accounting equation ensures that the balance sheet remains balanced. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company.

Main Elements of Financial Statements: Assets, Liabilities, Equity, Revenues, Expenses

The double entry accounting system recognizes a two-fold effect in every transaction. The balance of the total assets after considering all of the above transactions amounts to $36,450. It is equal to the combined balance of total liabilities of $20,600 and capital of $15,850 (a total of $36,450). At first glance, you probably don’t see a big difference from the basic accounting equation.

- To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO.

- With this equation in place, it can be seen that it can be rearranged too.

- Thus, these problems should be noted by all companies and strict method of valuation and recording of transactions should be done to control such problems.

- It’s essentially the same equation because net worth and owner’s equity are synonymous with each other.

- The accounting equation represents a fundamental principle of accounting that states that a company’s total assets are equal to the sum of its liabilities and equity.

- Other names for owner’s equity you may face are also net assets, or stockholder’s equity (for public corporations).

Accounting Equation And Why It Matters In Business

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. Suddenly, this deeper level of understanding will make you love the subject.

Commentaires récents